Severity: Notice

Message: Undefined variable: content_category

Filename: user/transcript.php

Line Number: 106

Severity: Warning

Message: Invalid argument supplied for foreach()

Filename: user/transcript.php

Line Number: 106

1) The cutting edge: Shaping the future of digital healthcare Digital healthcare, the convergence between life sciences and technology, is revolutionizing global markets

2) ii White & Case The cutting edge: Shaping the future of digital healthcare ii

3) The future of healthcare is here Digital healthcare, the convergence of life sciences and technology, is transforming medicine and revolutionizing global markets. D igital healthcare may soon provide the ability to process information from thousands of individuals, thus uncovering ways to improve patient outcomes. It could also lead to lower healthcare costs through data reviews that identify wasteful practices, high-quality healthcare for people living even in remote areas through remote monitoring and mHealth, platforms that allow distant doctors to collaborate, and many other life-saving innovations. The list evolves and expands every day. To learn more, we canvassed the opinions of 120 US-based senior-level executives in the life sciences and technology sectors to explore just how prepared they are for digital healthcare and the challenges they will face—be they strategic, operational or legal. The results of the survey are eye-opening and show unbridled enthusiasm for innovation and a desire for collaboration, albeit with justifiable wariness about several major potential obstacles. Make no mistake, a digital healthcare revolution is here. Those who act now could seize a significant competitive opportunity—while changing the face of healthcare for millions around the globe. Heather McDevitt Partner, White & Case Bijal Vakil Partner, White & Case The cutting edge: Shaping the future of digital healthcare 1

4) Digital healthcare in numbers F rom wearable technology and big data to remote monitoring and “mHealth, the digitized ” era of healthcare is upon us. In our survey, The cutting edge: Shaping the future of digital healthcare, nine out of ten survey respondents told us that digital healthcare plays a key role in their overall business strategy. In fact, 92 percent of life sciences and 96 percent of technology companies plan to increase their investment in digital healthcare over the next 18 months. To make the most of digital healthcare opportunities, companies from both sectors will need to collaborate. However, our survey found a potential divide, with 85 percent of life sciences and 82 percent of technology companies worried their business cultures are “incompatible. Fortunately, ” companies from both sectors see the advantages of bridging the divide, with each able to point out attractive aspects of a cross-sector partnership. Our survey also highlighted major legal challenges. More than 80 percent of technology and 75 percent of life sciences companies identified intellectual property (IP) issues as a barrier to growth in digital healthcare. And 73 percent of companies pointed to the absence of standardized global data privacy rules as a major barrier obstructing growth. Finally, in an indication of just how enticing the sector has become, 90 percent of technology and 82 percent of life sciences companies told us they would pursue a digital healthcare strategy even if they knew their products could not receive patent protection. 2 White & Case Strategic goals Opportunities 93% of companies say digital healthcare plays a key role in their overall business strategy Investment 92% of life sciences and 96% of technology companies plan to increase their investment in digital healthcare Room for growth Most respondents predict analytics and big data will generate the most growth in the next five years. Over the next 20 years, the focus will shift to remote monitoring and “mHealth” using mobile devices (see chart below) Which of these digital healthcare sectors do you see as the highest growth areas over the next 5 and 20 years? 5 years 20 years 29% 23% 27% 14% 7% 9% 11% 20% 53% 7% Analytics and big data Health outcomes and population health management Digital patient engagement Remote monitoring and mHealth Digital marketing

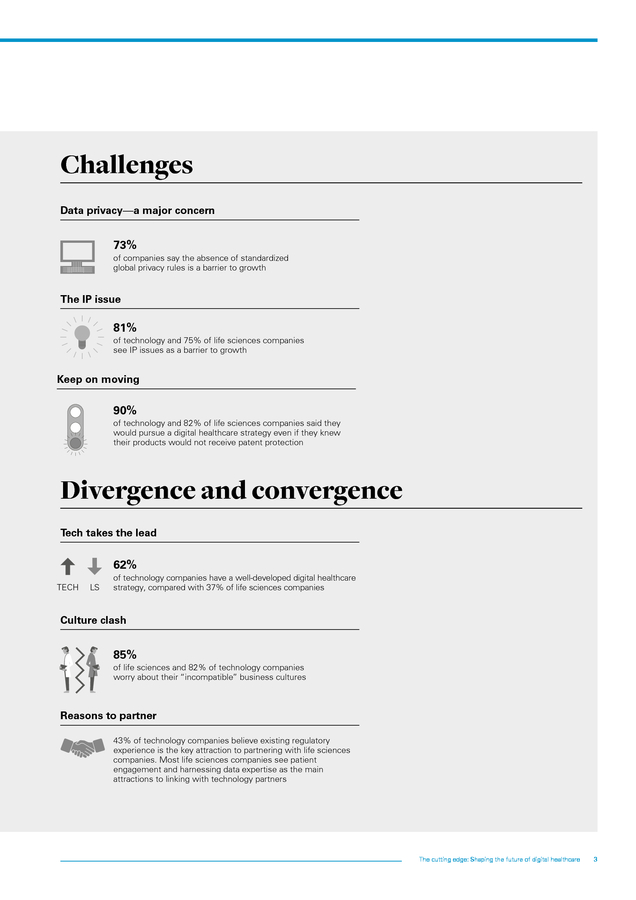

5) Challenges Data privacy—a major concern 73% of companies say the absence of standardized global privacy rules is a barrier to growth The IP issue 81% of technology and 75% of life sciences companies see IP issues as a barrier to growth Keep on moving 90% of technology and 82% of life sciences companies said they would pursue a digital healthcare strategy even if they knew their products would not receive patent protection Divergence and convergence Tech takes the lead 62% TECH LS of technology companies have a well-developed digital healthcare strategy, compared with 37% of life sciences companies Culture clash 85% of life sciences and 82% of technology companies worry about their “incompatible” business cultures Reasons to partner 43% of technology companies believe existing regulatory experience is the key attraction to partnering with life sciences companies. Most life sciences companies see patient engagement and harnessing data expertise as the main attractions to linking with technology partners The cutting edge: Shaping the future of digital healthcare 3

6) Contents Meeting of minds Taking the pulse of digital healthcare Page 16 Page 7 The keys to digital healthcare success Page 11 When giants meet—the convergence of life sciences and technology Privacy, patents and property Page 21 Fast-forward to a digital healthcare future Page 26 Page 14 Methodology In summer 2015, Mergermarket surveyed 120 US-based senior-level executives split equally between the technology and life sciences sectors. All respondents confirmed that they were responsible for their company’s digital healthcare strategy, and all respondents from the technology sector confirmed that their company had invested or was considering investing in a healthcare-related sector. Corporate revenues of respondent companies were split equally between US$1 – 5 billion and more than US$5 billion. The survey included a combination of qualitative and quantitative questions, and all interviews were conducted over the telephone by appointment. Results were analyzed and collated by Mergermarket, and all responses are anonymized and presented in aggregate.

7) Taking the pulse of digital healthcare HEADLINES n Nine out of ten companies say digital healthcare plays a key role in their overall business strategy n Most companies predict big data analysis will generate the most growth in the next five years; but the focus over the next two decades will then shift to remote monitoring and ”mHealth, healthcare delivered using mobile devices n Generation Xers (those born between 1965 – 1981) ” are expected to be the biggest adopters of digital healthcare consumer products within the next five years n 62% of technology companies have a well-developed digital healthcare strategy, compared with 37% of life sciences companies D igital healthcare is the intersection between two giant sectors—life sciences and technology. The lightning pace of technological and medical advances, increased healthcare spending and the needs of a growing and aging global population mean that digital healthcare is about to become a major sector in its own right. Our survey found a striking level of optimism about this change in the landscape, with more than 90 percent of respondents saying that digital healthcare now plays a key role in their overall business strategy. Market moves The opportunities emerging from this sector are vast. A recent study from BCC Research estimated that the market for medical devices, healthcare applications and related technology would have an annual compound growth rate of approximately 55 percent between 2013 and 2018—rising from US$2.4 billion to US$21.5 billion. As the global population grows, the world’s healthcare budgets are becoming more and more constrained. The National Health Service in England will face a £30 billion funding gap by 2020 – 21, according to some estimates. The US currently spends around 18 percent of its GDP on healthcare each year, and there are likely limits to how much more this spending can increase. Pioneering companies with the vision to stake a claim in this brave, new medical world are beginning to see the opportunities that digital healthcare offers. More than 7,500 start-ups around the world are developing new digital healthcare solutions, according to data from the StartUp Health Network. The exciting potential for digital healthcare includes the development of technologies that can transform patient outcomes and the global healthcare ecosystem. Technological solutions can make healthcare costs plummet (a recent Goldman Sachs report found an opportunity to save approximately US$305 billion through digital healthcare in the near future), thus also granting more people greater access to treatment. The American Medical Association’s Accelerating Change in Medical Education program is helping to fund new medical school classes to teach how technical solutions can provide better care for patients. At the same time, the Massachusetts Institute for Technology has even begun staging healthcare “hackathons” where , computer programmers collaborate intensively over a 24-hour period to look for better ways to manage hospital IT or monitor chronic conditions such as diabetes. The journey begins According to our survey, technology companies are currently ahead of 93% of companies say digital healthcare plays a key role in overall business strategy 53% of companies believe that remote monitoring will be the highest growth area in the next 20 years their life sciences counterparts in preparing for a digital future, with 62 percent saying they have welldeveloped plans to bring new digital healthcare products to market. “There is no question that digital healthcare is the way forward, said ” one Vice President of Healthcare and Life Sciences at a technology company. “It is reducing death rates, hospitalizations and healthcare costs. It is an exciting area of growth for us, and we are completely focused on getting our product to market as fast as possible. ” Among life sciences companies, 37 percent gave the same answer, with a further 30 percent saying they are still evaluating priorities or are at an exploratory, planning or pilot stage. A number of trends are driving rapid development in this sector and drawing in players who might previously have remained on the sidelines. These trends include wearable technologies such as fitness trackers, biosensors that monitor the vital signs of people with heart disease, and other innovations, such as ingestible devices that measure medication levels, with revolutionary potential to alter how patients and their healthcare providers monitor and treat diseases. These new wearable monitors are, in turn, connected to a new generation of data collection software, capable of gathering and processing The cutting edge: Shaping the future of digital healthcare 5

8) How important is digital healthcare to your overall business strategy? Technology company Life sciences company 100 92% 93% 80 60 40 20 8% 0 Key role in current strategy 7% Minor role in current strategy vast amounts of individuals’ health information to understand more details of disease progression, symptom triggers and the efficacy of treatments. In the immediate future, this new field of “big data” or predictive analytics is set to become one of the most effective and lucrative elements of digital healthcare. Decades after it was first discussed, remote monitoring and mHealth is finally coming into its own, transforming functions such as the transmission of scanned images between doctors and the availability of expert medical assistance for elderly, housebound and geographically isolated individuals. Big data is big news Big data technology can help improve early diagnosis and prevent the development of more serious conditions. Among our survey respondents in both sectors, 29 percent identified big data as the most important element of digital healthcare over the next five years, with digital patient engagement (27 percent) and health outcome management (23 percent) close behind. How well developed are your company’s digital healthcare strategies? Technology company Remote monitoring is closer According to the US Centers for Disease Control, more than half Which of these digital healthcare fields do you see as the highest growth area in the next 5 and 20 years? Life sciences company Next 5 years Well-developed Next 20 years Analytics and big data 62% 37% Implemented 29% 9% Health outcomes and population health management 23% 22% 33% At the pilot stage 11% Digital patient engagement 27% 16% 15% Planning stage 20% Remote monitoring and mHealth 14% 0% 12% Exploratory/researching 53% Digital marketing 0% 7% 3% 6 Dimitrios Drivas, White & Case’s Global Intellectual Property Practice Leader, explains the opportunities that this big data revolution can bring. “New businesses focusing on chronic disease management will be able to gather data from thousands or even millions of patients, evaluate various treatment pathways based on patient responses, and thus identify the optimal treatment options for particular individuals, ” he says. “I think we may see a range of new and different players entering this field, leading a global healthcare transformation. ” Survey respondents echo this view. “The availability of analytics software has boosted the confidence of healthcare providers, ” said one Vice President of Strategy, Innovation and Architecture in a life sciences company that is already marketing digital healthcare technology. “Doctors feel they have a better understanding of patient behavior, a better framework for introducing new treatments and improved quality of care. ” 7% White & Case

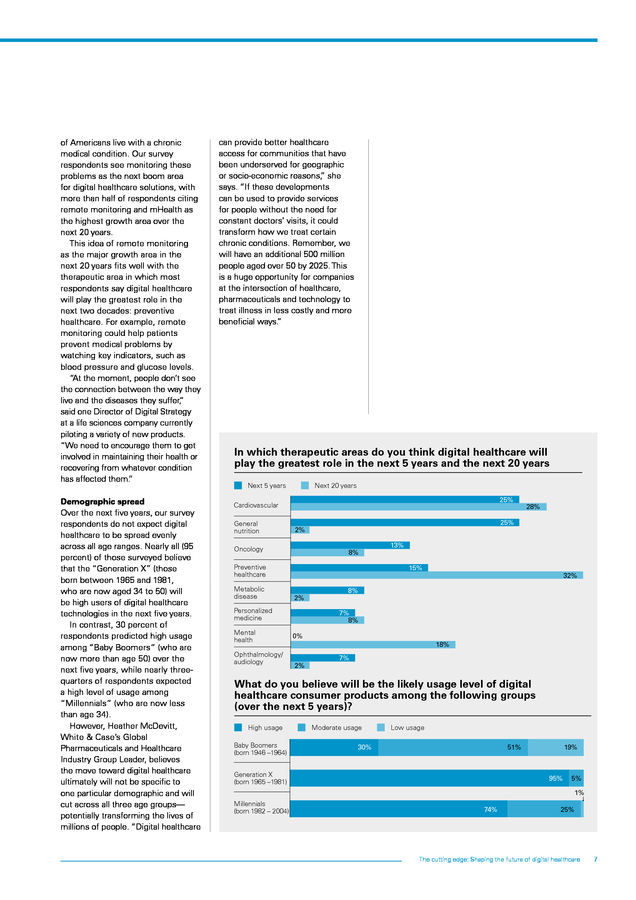

9) of Americans live with a chronic medical condition. Our survey respondents see monitoring these problems as the next boom area for digital healthcare solutions, with more than half of respondents citing remote monitoring and mHealth as the highest growth area over the next 20 years. This idea of remote monitoring as the major growth area in the next 20 years fits well with the therapeutic area in which most respondents say digital healthcare will play the greatest role in the next two decades: preventive healthcare. For example, remote monitoring could help patients prevent medical problems by watching key indicators, such as blood pressure and glucose levels. “ the moment, people don’t see At the connection between the way they live and the diseases they suffer, ” said one Director of Digital Strategy at a life sciences company currently piloting a variety of new products. “We need to encourage them to get involved in maintaining their health or recovering from whatever condition has affected them. ” Demographic spread Over the next five years, our survey respondents do not expect digital healthcare to be spread evenly across all age ranges. Nearly all (95 percent) of those surveyed believe that the “Generation X” (those born between 1965 and 1981, who are now aged 34 to 50) will be high users of digital healthcare technologies in the next five years. In contrast, 30 percent of respondents predicted high usage among “Baby Boomers” (who are now more than age 50) over the next five years, while nearly threequarters of respondents expected a high level of usage among “Millennials” (who are now less than age 34). However, Heather McDevitt, White & Case’s Global Pharmaceuticals and Healthcare Industry Group Leader, believes the move toward digital healthcare ultimately will not be specific to one particular demographic and will cut across all three age groups— potentially transforming the lives of millions of people. “Digital healthcare can provide better healthcare access for communities that have been underserved for geographic or socio-economic reasons, she ” says. “If these developments can be used to provide services for people without the need for constant doctors’ visits, it could transform how we treat certain chronic conditions. Remember, we will have an additional 500 million people aged over 50 by 2025. This is a huge opportunity for companies at the intersection of healthcare, pharmaceuticals and technology to treat illness in less costly and more beneficial ways. ” In which therapeutic areas do you think digital healthcare will play the greatest role in the next 5 years and the next 20 years Next 5 years Next 20 years 25% Cardiovascular General nutrition 25% 2% Oncology 8% Preventive healthcare Metabolic disease Ophthalmology/ audiology 13% 15% 2% Personalized medicine Mental health 28% 32% 8% 7% 8% 0% 18% 2% 7% What do you believe will be the likely usage level of digital healthcare consumer products among the following groups (over the next 5 years)? High usage Baby Boomers (born 1946 –1964) Moderate usage Low usage 30% 51% Generation X (born 1965 –1981) 19% 95% 5% 1% Millennials (born 1982 – 2004) 74% 25% The cutting edge: Shaping the future of digital healthcare 7

10) 8 White & Case

11) The keys to digital healthcare success HEADLINES n 92% of life sciences and 96% of technology companies plan to increase their investment in digital healthcare n Lack of awareness among patients and consumers is seen as the biggest practical obstacle to the broader use of digital healthcare services and devices n Most companies see the creation of new, proprietary products as the best route for entering and succeeding in digital healthcare n 55% of life sciences companies see partnering as the best route for entering and succeeding in digital healthcare n 63% of technology and 50% of life sciences companies see M&A as an attractive route for entering and succeeding in digital healthcare, though 88% of them say digital healthcare assets are overvalued T he perceived opportunities in digital healthcare are generating considerable excitement about the investment prospects for the sector and the prospect of a boom in innovations, acquisitions and perhaps even completely new types of business partnerships. Over the next 18 months, 92 percent of the life sciences companies and 96 percent of the technology companies we surveyed report that they plan to increase their investment in digital healthcare. Increasing investment Both sectors agree on digital healthcare’s investment potential: 48 percent of technology companies said they expected a significant increase, and 48 percent a moderate increase in their overall investment in digital healthcare. Meanwhile, 42 percent of life sciences companies planned a significant increase in investment, and 50 percent a moderate one. However, they differ slightly on the best routes for entering and succeeding in digital healthcare. The vast majority of technology companies said their strategy will be driven by creating new proprietary products and acquiring others in development. In contrast, 55 percent of life sciences companies placed the highest priority on partnering as a route to entering and succeeding in digital healthcare. This is interesting given that 44 percent of life sciences companies viewed technology companies’ entry into healthcare as a threat. Life sciences companies ranked creating new products and acquisitions second and third almost equally: 52 percent and 50 percent, respectively. respondents believed that digital healthcare companies are significantly or moderately overvalued. Even companies that think these assets are overvalued still want to be involved in developing technologies that can contain healthcare costs, collect enormous quantities of data, measure patient outcomes and deliver more effective solutions. Leslie Morioka, a White & Case Intellectual Property partner, says client feedback about digital healthcare innovators is largely positive. “This is a real sea change in healthcare. Everyone is trying to come up with new ideas and new ways of doing things. The digital healthcare High valuations won’t stop M&A As digital healthcare enters the mainstream, this could prompt a new wave of M&A for companies that are no stranger to the dealmaking table. More than half of our survey respondents saw M&A as an attractive route for entering and succeeding in digital healthcare, despite the fact that 88 percent of What are the practical obstacles to broader use of digital healthcare services and devices? Most important Second most important Third most important Patients and consumers unaware of services 29% Older patients not digitally aware 17% Privacy and security concerns 20% 15% Physicians not promoting services 10% Too-little guidance from medicines regulatory agencies Insurance company coverage for new products 5% 20% 13% 15% 5% 13% 9% 14% 18% 13% 19% Healthcare systems ill-equipped 17% 11% 13% 14% 10% The cutting edge: Shaping the future of digital healthcare 9

12) company that successfully takes us to the next step can dramatically improve results for patients while gaining a competitive advantage. ” Obstacles to overcome This investment optimism is tempered by frustration over the continuing lack of awareness of available services among patients and consumers, with 60 percent of survey respondents seeing this as one of the biggest obstacles to the broader use of digital healthcare services and devices. The second-highest obstacle was also related to consumers—with 55 percent of survey respondents citing a lack of digital awareness among older patients. One powerful force pressing for these new technologies may come from insurance companies using data collection to encourage people to adopt healthier lifestyles and subscribe to preventive healthcare packages. If people won’t be covered by insurance unless they participate in preventive healthcare, this could become a very effective tool for promoting behavior change. Many respondents worried about the risks of failing to protect confidential data, with 48 percent seeing privacy and security concerns as a key obstacle to the broader use of digital healthcare services and devices. Many of those looking to enter digital healthcare do not realize the need for a “privacy by design” strategy. This type of strategy would allow companies to create innovations with built-in protection from problems resulting from security failures along with processes for handling highly confidential healthcare information as it is moved among users, providers and platforms. Daren Orzechowski, a White & Case Sourcing & Technology Transactions partner, predicts concerns about privacy strategies: “People have always been very conscious of privacy in Europe but, until recently, Americans were much more relaxed about it, he says. “All that has ” changed in recent years, and now questions over contractual and technical controls to protect the transfer of individuals’ data have 10 White & Case become an essential part of product development and due diligence in M&A. We have seen deals die because data cannot be moved without the consent of all of the individuals concerned. ” A number of survey respondents echoed his sentiments. “Research collaborations are being totally blocked because of data transfer regulations, said one Head of ” Digital Marketing and Strategy in a life sciences company. “It is becoming a real barrier to growth. ” (For more on data privacy and legal challenges, please see page 21.) In addition, 43 percent of survey respondents noted resistance among physicians to a changing healthcare landscape. “A lot of clinicians view the use of technology as a disruption to their work, said one Director of ” Digital Customer Engagement in a life sciences company. “They are not promoting these services themselves but are being forced to use them by the payers to improve the potential value of the industry. We need to educate them better and get them properly on board. ” “This is not happening as fast as it should, because there is simply a lack of awareness of the huge potential benefits, said one ” Director of a life sciences company. “Although the market is picking up slowly, the hesitation of doctors has meant investors are not confident that they will use new innovations, and they don’t want to risk their investment in nonperforming technology. This is something we are working hard to overcome. ” Tech takes the lead One obstacle stated by a number of life sciences companies was that they are lagging behind in their move into the digital age. While 62 percent of technology companies described their digital healthcare strategy as well-developed, just over a third of life sciences said the same. And while 30 percent of life sciences companies said their strategies were either at the exploratory/planning or pilot stage, only 16 percent of technology companies said the same. Some senior staff voiced their frustrations: “We are just too fearful about investing and adopting newer technologies for our products. We need to take a few more risks, ” said one Digital Director at a US life sciences company. One Director of Healthcare at a US technology company expressed a similar view: “Life sciences companies lack the necessary understanding and are satisfied with hanging onto their traditional ways of doing things. ” As a result, a number of technology companies in our survey said they are making progress on their own, by tackling the issues of collection, storage and transfer of patient data in other ways. “We have focused on the growing importance of storage facilities for hospitals and healthcare companies to record and access their patient information at the same time as keeping it secure against minor errors or leakages, said one ” Director of Healthcare Solutions at a technology company. “We are successfully increasing our offering within this space. ” There are several businesses in a prime position to take a lead in this field. We are already seeing some of them come forward. Jeff Oelke, Intellectual Property partner, White & Case

13) What is your opinion of the current valuation of companies focused on digital healthcare? Moderately undervalued 1% Correctly valued 11% Significantly overvalued 15% Moderately overvalued 73% Over the next 18 months, will your overall investment in digital healthcare: Technology company Life sciences company 48% Increase significantly 42% 48% Increase somewhat Remain the same Decrease somewhat 50% 4% 7% 0% 1% What do you feel is your best route for entering and succeeding in digital healthcare? Technology company Life sciences company 68% Create new, proprietary products 52% 63% Acquisitions 50% 43% Partnering 55% 40% Investment in large venture capital 43% 18% Investment in seed funds Joint ventures 15% 7% 20% Multi-player collaborations Outsourcing to digital healthcare providers 10% 12% 2% 10% The cutting edge: Shaping the future of digital healthcare 11

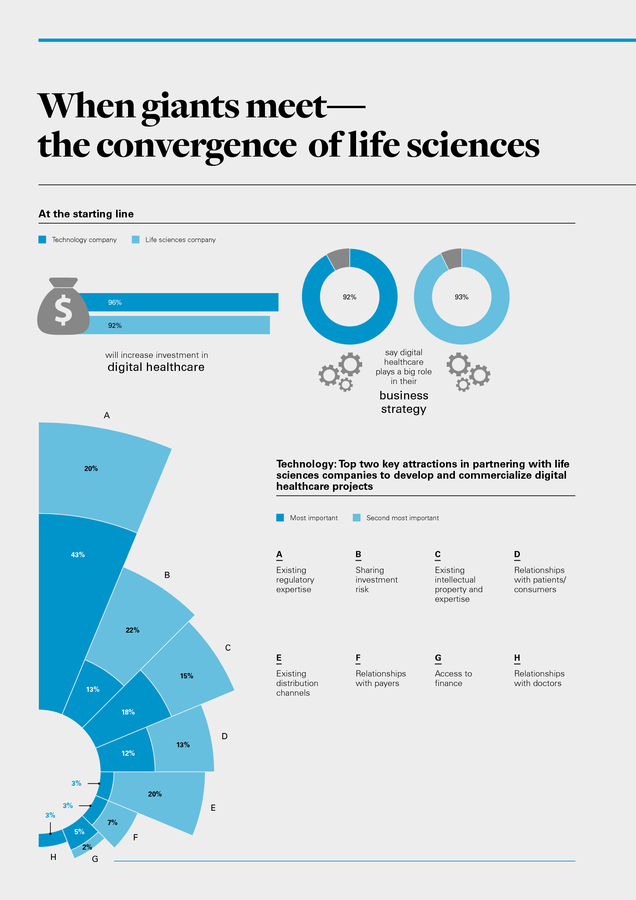

14) When giants meet— the convergence of life sciences At the starting line Technology company Life sciences company 92% 96% 93% 92% say digital healthcare plays a big role in their will increase investment in digital healthcare business strategy A Technology: Top two key attractions in partnering with life sciences companies to develop and commercialize digital healthcare projects 20% Most important Second most important A C D Sharing investment risk Existing intellectual property and expertise Relationships with patients/ consumers E F G H Existing distribution channels B B Existing regulatory expertise 43% Relationships with payers Access to finance Relationships with doctors 22% C 15% 13% 18% D 13% 12% 3% 20% 3% E 3% 7% 5% F 2% H G

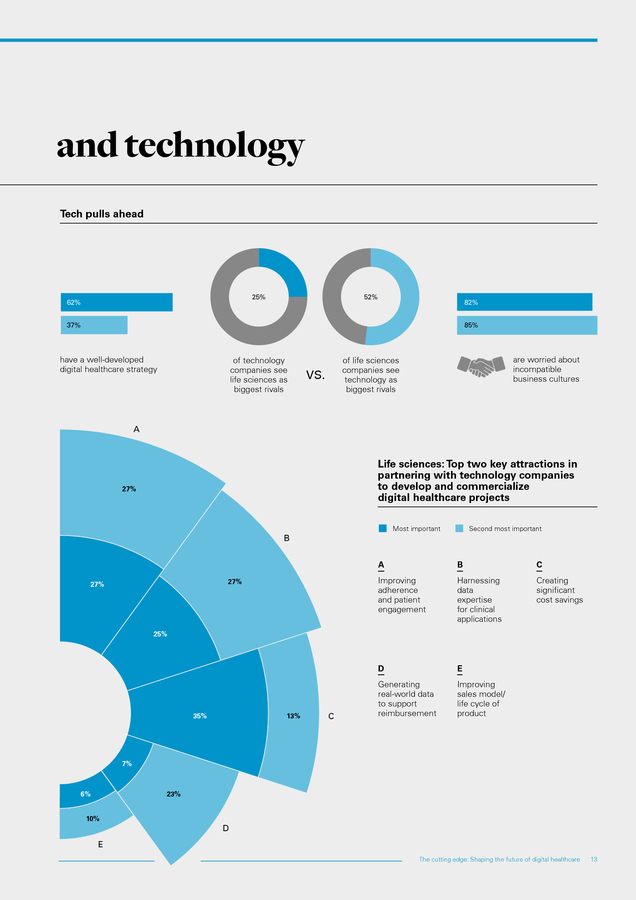

15) and technology Tech pulls ahead 25% 62% 52% 82% 37% 85% have a well-developed digital healthcare strategy of technology companies see life sciences as biggest rivals are worried about incompatible business cultures of life sciences companies see technology as biggest rivals VS. A Life sciences: Top two key attractions in partnering with technology companies to develop and commercialize digital healthcare projects 27% Most important Second most important B A C Improving adherence and patient engagement Harnessing data expertise for clinical applications Creating significant cost savings D 27% 27% B E Generating real-world data to support reimbursement Improving sales model/ life cycle of product 25% 35% 13% C 7% 23% 6% 10% D E The cutting edge: Shaping the future of digital healthcare 13

16) Meeting of minds HEADLINES n When it comes to cross-sector partnerships, 82% of technology and 85% of life sciences companies worry about their potentially incompatible business cultures n 52% of life sciences companies see technology companies as their main competitors in digital healthcare n Only a quarter of technology companies see life sciences companies as their primary competition n The majority of technology companies feel life sciences companies’ regulatory experience would be the most attractive aspect of a partnership n For life sciences companies looking to partner with a technology rival, the most attractive aspects would be improving patient engagement and harnessing the technology sector’s data expertise J ust as media and entertainment companies are often indistinguishable now, life sciences and technology companies could embrace convergence, join forces to pool their resources and explore the benefits that digital healthcare can bring them. For this sector to flourish, convergence and partnerships are not just desirable but fundamental. The best of both worlds When looking at their own digital healthcare ambitions, survey respondents from both sectors viewed the complexity of their projects (52 percent) and regulatory barriers (37 percent) as the top obstacles to their success. However, it is exactly these challenges that can be best overcome by collaboration. According to our survey, both sides can see how convergence would be beneficial in overcoming these hurdles. 43 percent of technology companies stated that existing regulatory expertise is the main factor that would attract them to partnering with life sciences companies to develop and commercialize digital healthcare projects. Meanwhile, life sciences companies saw three key attractions to partnering with technology companies: improving patient engagement, harnessing the technology sector’s data expertise and creating significant cost savings. According to Leslie Morioka, the companies that know how to collaborate will produce the best 14 White & Case 82% of technology companies are worried about incompatible business cultures 85% of life sciences companies are worried about culture clash results. “Companies may have to join forces if they want to succeed, ” she says. “Similar integration models already exist in other industries such as media and entertainment. ” Suspicious minds Despite the potential value to both of these sectors if they work together, our survey showed that lingering suspicion and hostility is impeding progress. Interestingly, both technology (75 percent) and life sciences (52 percent) companies saw technology businesses as their biggest rivals in digital healthcare. In addition, nearly half of life sciences companies (44 percent) viewed technology companies’ entry into healthcare as a threat. “The inroads being made into healthcare by the technology giants are certainly a threat for companies like us, suggests one Digital ” Director at a US-based life sciences company. “Most of the companies in our industry are not yet dominant in digital healthcare, and the technology companies are entering this market aggressively and are offering quality products. ” When asked what might prevent them from partnering with a technology company, 85 percent of life sciences companies raised concerns about linking their business model with that of a technology company and possibly creating a “culture clash. They ” also worried about an unclear return on investment in such a partnership (43 percent) and a lack of regulation in the technology sector (38 percent). Technology companies were concerned about the risk of an incompatible business culture (82 percent) if they joined forces with a life sciences company. They also worried about the slow speed of decision-making in the life sciences sector (58 percent), reflecting a perceived risk of a clash in terms of strategic approach and culture. Come together From the perspective of both survey respondents and White & Case partners, this perceived incompatibility is something the major players in both sectors can overcome. White & Case Intellectual Property partner and Silicon Valley Office Executive Partner, Bijal Vakil, puts this succinctly. “We are on the edge of a huge long-term transformation of the healthcare landscape, he ” says. “There is no question that, despite their different philosophies, technology and life sciences companies can come together. ” According to Heather McDevitt, the view of life sciences companies as notably slow to make decisions may be outdated. “In my view, they are approaching these types of business opportunities quite strategically and in a more innovative way these days, because everyone sees the growth potential in this sector. ” One of the keys to overcoming perceived cultural barriers, according to White & Case Intellectual Property

17) What do you see as the key obstacles to your success in digital healthcare? Most important Second most important Level of complexity 27% 25% Legal/regulatory barriers Lack of access to decisionmakers within the system 17% 12% 18% 5% High valuations Key decision-makers do not see relevance of digital technologies 12% 17% Level of competition Lack of knowledge/ intellectual property 25% 17% 5% 10% 6% 4% Who would you regard as your primary competitors in digital healthcare? Technology company Life sciences company 75% Technology companies are primary competitors 52% 25% Life sciences companies are primary competitors 48% Do you view the inroads into healthcare being made by technology giants as a threat or an opportunity (life sciences only)? Threat 44% 56% Opportunity The cutting edge: Shaping the future of digital healthcare 15

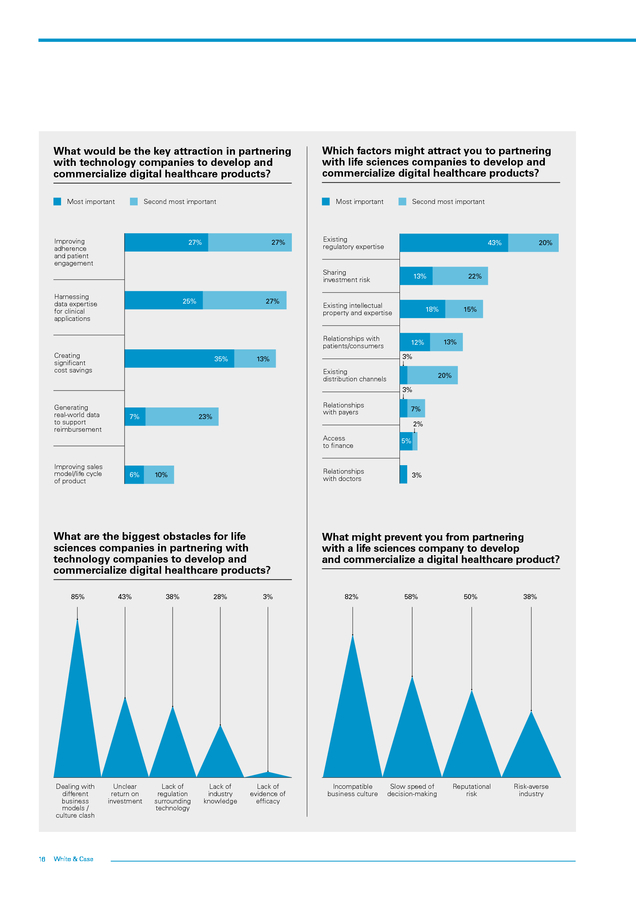

18) What would be the key attraction in partnering with technology companies to develop and commercialize digital healthcare products? Most important Second most important Improving adherence and patient engagement Which factors might attract you to partnering with life sciences companies to develop and commercialize digital healthcare products? Most important 27% 27% Second most important Existing regulatory expertise 43% Sharing investment risk Harnessing data expertise for clinical applications 25% 27% Existing intellectual property and expertise Relationships with patients/consumers Creating significant cost savings 35% 13% 22% 18% 12% 20% 15% 13% 3% 13% Existing distribution channels 20% 3% Generating real-world data to support reimbursement 7% Relationships with payers 23% 2% Access to finance Improving sales model/life cycle of product 6% Relationships with doctors 10% What are the biggest obstacles for life sciences companies in partnering with technology companies to develop and commercialize digital healthcare products? 85% Dealing with different business models / culture clash 16 White & Case 7% 5% 3% What might prevent you from partnering with a life sciences company to develop and commercialize a digital healthcare product? 43% 38% 28% 3% 82% 58% 50% 38% Unclear return on investment Lack of regulation surrounding technology Lack of industry knowledge Lack of evidence of efficacy Incompatible business culture Slow speed of decision-making Reputational risk Risk-averse industry

19) Life sciences companies are approaching these types of business opportunities quite strategically and in a more innovative way these days. Heather McDevitt, Global Pharmaceuticals and Healthcare Industry Group Leader, White & Case partner Jeff Oelke, is to look for people within an organization who have worked in both sectors. “There are individuals who have spent time in both industries and already know how to work well together. ” He adds that adaptability will also be crucial. “Some companies and people will be able to figure out how to work together, because they can adapt to changing and challenging circumstances, he says. ” Several companies are already proving their flexibility in digital healthcare. The global medical devices giant Medtronics has already joined forces with IBM and other major information technology players to transfer IBM’s data processing experience to the sensitive field of healthcare. The joint project will gather anonymized patient data and analyze it for clues to provide individualized healthcare, thus improving outcomes and cutting costs. It is evidence of the growing momentum behind efforts to release valuable information and business opportunities from the proprietary silos that are currently blocking advances in treatment and improved wellness. As Oelke points out, “It is clear that, among the companies we surveyed in both sectors, there are people with the drive and vision to collaborate. The entire concept of digitizing healthcare services and products will require strengths from both sectors. They are going to need each other. ” What do you see as the most challenging aspects of formulating licensing agreements between life sciences and technology companies? Exclusive vs. non-exclusive Duration Large up fronts vs. performance-related milestones 19% 23% 58% The cutting edge: Shaping the future of digital healthcare 17

20) 18 White & Case

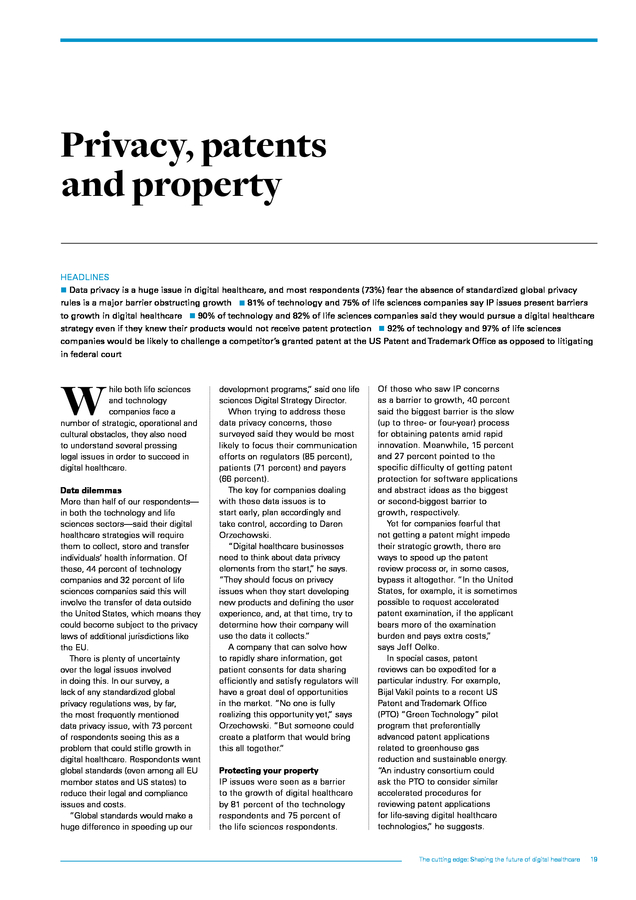

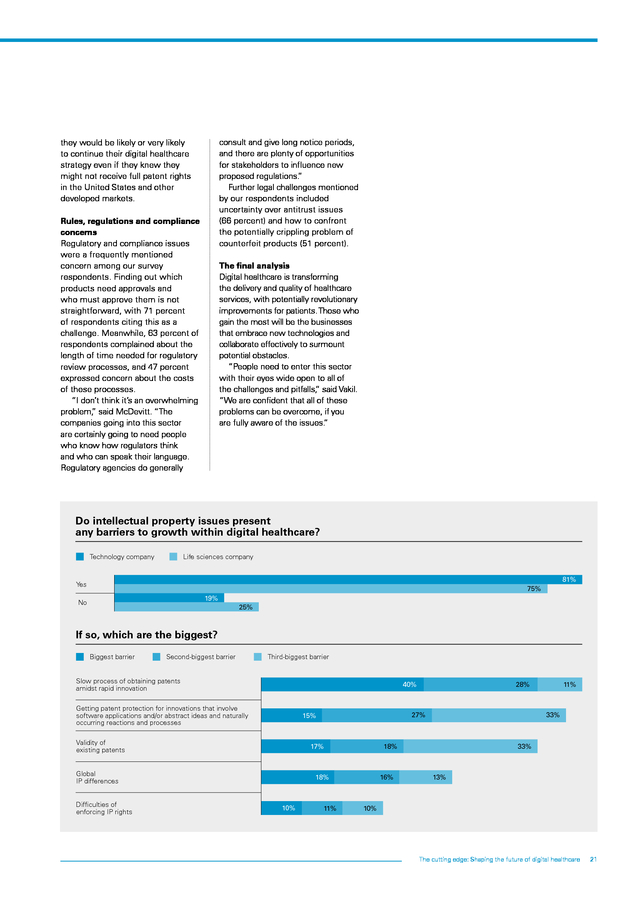

21) Privacy, patents and property HEADLINES n Data privacy is a huge issue in digital healthcare, and most respondents (73%) fear the absence of standardized global privacy rules is a major barrier obstructing growth n 81% of technology and 75% of life sciences companies say IP issues present barriers to growth in digital healthcare n 90% of technology and 82% of life sciences companies said they would pursue a digital healthcare strategy even if they knew their products would not receive patent protection n 92% of technology and 97% of life sciences companies would be likely to challenge a competitor’s granted patent at the US Patent and Trademark Office as opposed to litigating in federal court W hile both life sciences and technology companies face a number of strategic, operational and cultural obstacles, they also need to understand several pressing legal issues in order to succeed in digital healthcare. Data dilemmas More than half of our respondents— in both the technology and life sciences sectors—said their digital healthcare strategies will require them to collect, store and transfer individuals’ health information. Of these, 44 percent of technology companies and 32 percent of life sciences companies said this will involve the transfer of data outside the United States, which means they could become subject to the privacy laws of additional jurisdictions like the EU. There is plenty of uncertainty over the legal issues involved in doing this. In our survey, a lack of any standardized global privacy regulations was, by far, the most frequently mentioned data privacy issue, with 73 percent of respondents seeing this as a problem that could stifle growth in digital healthcare. Respondents want global standards (even among all EU member states and US states) to reduce their legal and compliance issues and costs. “Global standards would make a huge difference in speeding up our development programs, said one life ” sciences Digital Strategy Director. When trying to address these data privacy concerns, those surveyed said they would be most likely to focus their communication efforts on regulators (85 percent), patients (71 percent) and payers (66 percent). The key for companies dealing with these data issues is to start early, plan accordingly and take control, according to Daren Orzechowski. “Digital healthcare businesses need to think about data privacy elements from the start, he says. ” “They should focus on privacy issues when they start developing new products and defining the user experience, and, at that time, try to determine how their company will use the data it collects. ” A company that can solve how to rapidly share information, get patient consents for data sharing efficiently and satisfy regulators will have a great deal of opportunities in the market. “No one is fully realizing this opportunity yet, says ” Orzechowski. “But someone could create a platform that would bring this all together. ” Protecting your property IP issues were seen as a barrier to the growth of digital healthcare by 81 percent of the technology respondents and 75 percent of the life sciences respondents. Of those who saw IP concerns as a barrier to growth, 40 percent said the biggest barrier is the slow (up to three- or four-year) process for obtaining patents amid rapid innovation. Meanwhile, 15 percent and 27 percent pointed to the specific difficulty of getting patent protection for software applications and abstract ideas as the biggest or second-biggest barrier to growth, respectively. Yet for companies fearful that not getting a patent might impede their strategic growth, there are ways to speed up the patent review process or, in some cases, bypass it altogether. “In the United States, for example, it is sometimes possible to request accelerated patent examination, if the applicant bears more of the examination burden and pays extra costs, ” says Jeff Oelke. In special cases, patent reviews can be expedited for a particular industry. For example, Bijal Vakil points to a recent US Patent and Trademark Office (PTO) “Green Technology” pilot program that preferentially advanced patent applications related to greenhouse gas reduction and sustainable energy. “An industry consortium could ask the PTO to consider similar accelerated procedures for reviewing patent applications for life-saving digital healthcare technologies, he suggests. ” The cutting edge: Shaping the future of digital healthcare 19

22) Does your digital healthcare strategy include any plans to collect, store, transfer and/or share individuals’ health information? Technology company Life sciences company 55% Yes 60% 45% No 40% Will this information be transferred outside of the United States? Technology company Life sciences company 44% Yes 32% 56% No 68% Which data privacy issues represent the biggest barriers to digital healthcare growth? Biggest barrier Second-biggest barrier Lack of any standardized global privacy regulations 47% Interpretation of regulations (e.g., HIPAA/ HITECH/FTC Acts) 11% 23% General public/patients’ lack of confidence Legislation in individual states (e.g., Sunshine Act) 23% 8% Physician opposition 26% 10% 19% 10% 11% 1% European privacy issues 11% Who are your communication efforts directed towards (or would they be directed towards) to address privacy concerns? Most important Second most important Regulators 25% Payers Governments 20 White & Case 25% 45% Patients General public Third most important 19% 7% 4% 24% 17% 7% 27% 23% 25% 18% 19% 15% Also, most companies can file a patent application—thus staking a claim for priority—and start selling a product immediately (assuming there are no FDA or other regulatory requirements). “Particularly with today’s rapidly shifting information technology, you may have to get your product out quickly and begin building momentum in the market while you wait for your patent to be reviewed, says Vakil. ” Some digital healthcare inventions may benefit from trade secret protections instead of patents. Companies need to keep their data, product details, algorithms and processes confidential to protect trade secrets. “Whether you actually file for a patent at all is a business decision. If you decide to protect your intellectual property as a trade secret, like a closely guarded recipe for a soft drink or food product, then you don’t have to disclose it publicly, as you would in a patent filing, says Oelke. ” Patents may not always foster innovation, according to some commentators. “The Patent and Trademark Office is seriously understaffed ... many patent examinations are perfunctory, and there is a general concern that too many patents are being issued, ” wrote the eminent Judge Richard Posner in The Atlantic magazine. Posner and other authorities have suggested reducing the length of patent protection from the current 20 years in industries that do not have the long development and testing time of pharmaceutical treatments, instituting a system of compulsory licensing of patented inventions and several other patent reforms. A 2015 report in The Economist condemned the US practice of extending patent protection to business processes and financial products, claiming that 40 – 90 percent of patents issued are never used or licensed by their owners, but serve purely as a means of blocking rivals and denying market access to competitors. All this may explain why 90 percent of our technology respondents and 82 percent of our life sciences respondents still said

23) consult and give long notice periods, and there are plenty of opportunities for stakeholders to influence new proposed regulations. ” Further legal challenges mentioned by our respondents included uncertainty over antitrust issues (66 percent) and how to confront the potentially crippling problem of counterfeit products (51 percent). they would be likely or very likely to continue their digital healthcare strategy even if they knew they might not receive full patent rights in the United States and other developed markets. Rules, regulations and compliance concerns Regulatory and compliance issues were a frequently mentioned concern among our survey respondents. Finding out which products need approvals and who must approve them is not straightforward, with 71 percent of respondents citing this as a challenge. Meanwhile, 63 percent of respondents complained about the length of time needed for regulatory review processes, and 47 percent expressed concern about the costs of these processes. “I don’t think it’s an overwhelming problem, said McDevitt. “The ” companies going into this sector are certainly going to need people who know how regulators think and who can speak their language. Regulatory agencies do generally The final analysis Digital healthcare is transforming the delivery and quality of healthcare services, with potentially revolutionary improvements for patients. Those who gain the most will be the businesses that embrace new technologies and collaborate effectively to surmount potential obstacles. “People need to enter this sector with their eyes wide open to all of the challenges and pitfalls, said Vakil. ” “We are confident that all of these problems can be overcome, if you are fully aware of the issues. ” Do intellectual property issues present any barriers to growth within digital healthcare? Technology company Life sciences company 81% Yes 75% 19% No 25% If so, which are the biggest? Biggest barrier Second-biggest barrier Third-biggest barrier Slow process of obtaining patents amidst rapid innovation 40% Getting patent protection for innovations that involve software applications and/or abstract ideas and naturally occurring reactions and processes 17% Global IP differences Difficulties of enforcing IP rights 27% 15% Validity of existing patents 11% 16% 11% 33% 18% 18% 10% 28% 33% 13% 10% The cutting edge: Shaping the future of digital healthcare 21

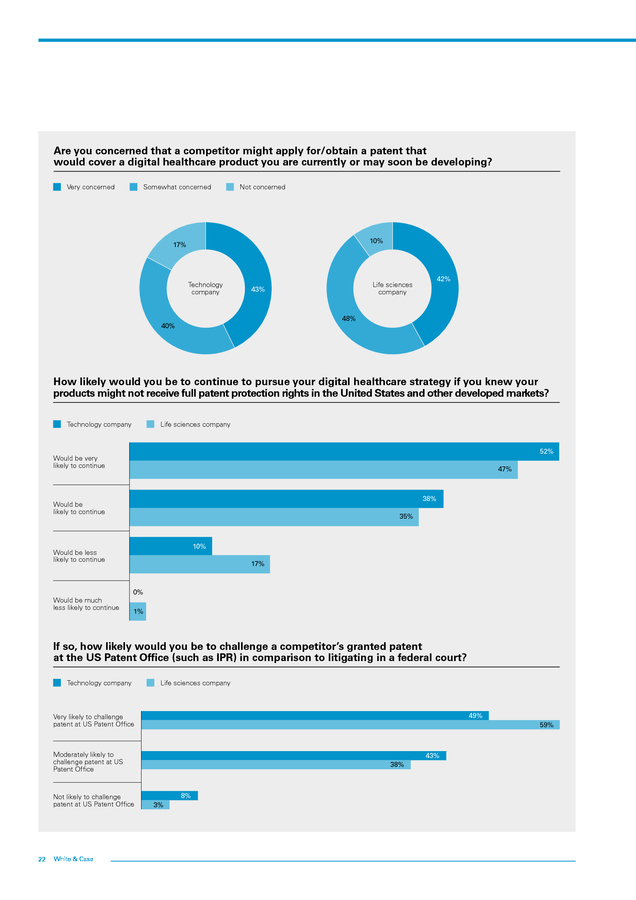

24) Are you concerned that a competitor might apply for/obtain a patent that would cover a digital healthcare product you are currently or may soon be developing? Very concerned Somewhat concerned Not concerned 10% 17% Technology company 42% Life sciences company 43% 48% 40% How likely would you be to continue to pursue your digital healthcare strategy if you knew your products might not receive full patent protection rights in the United States and other developed markets? Technology company Life sciences company 52% Would be very likely to continue 47% 38% Would be likely to continue 35% 10% Would be less likely to continue Would be much less likely to continue 17% 0% 1% If so, how likely would you be to challenge a competitor’s granted patent at the US Patent Office (such as IPR) in comparison to litigating in a federal court? Technology company Life sciences company 49% Very likely to challenge patent at US Patent Office 59% Moderately likely to challenge patent at US Patent Office Not likely to challenge patent at US Patent Office 22 White & Case 43% 38% 8% 3%

25) What are the principal regulatory and compliance challenges that lie ahead for digital healthcare? Biggest challenge Second-biggest challenge Third-biggest challenge Understanding which products will need regulatory review 23% 30% Length of time needed for review process 33% Cost of the review process 20% Stance of different regulators (e.g., FDA/EMA) 8% 13% 12% 13% 9% 16% 11% 13% Establishing independent ethics boards 21% 18% 9% 2% Recruitment of specialized regulatory employees 6% 14% 1% False Claims Act Anti-bribery (or similar issues) 4% 3% 18% 3% What other key legal issues concern you in developing digital healthcare products? Biggest concern Second-biggest concern 48% Antitrust issues Counterfeit products 23% Confidentiality breaches Constant stream of litigation among competitors 28% 21% 8% 18% 22% 32% The cutting edge: Shaping the future of digital healthcare 23

26) Peek www.peekvision.org Fast-forward to a digital healthcare future 24 White & Case NY0105/TL/B/147208_23

27) Digital healthcare advances can bring quality healthcare to areas that previously have been underserved O ur survey findings show that digital healthcare is the future—one that is arriving very quickly. People currently without accessible or adequate healthcare because of poverty or geographic location could now receive highquality treatments. Products that capture and process staggering amounts of individual health data could increase our understanding of specific diseases and improve patient outcomes. Demographic trends toward an aging population and rising rates of chronic illnesses could create unprecedented demand for new healthcare services. To succeed in digital healthcare, life sciences and technology companies will need to overcome several challenges. Both sectors may also need to find ways to work together effectively, and the winners will be those who understand this now. Six key insights emerged from our survey that future leaders in both sectors should begin exploring immediately. Today is big. Tomorrow is remote. Big data analysis is likely to attract the most interest and investment in the next five years, but later this will be superseded by investment in remote monitoring and mHealth. Data is power. Life sciences companies recognize the unrivalled resource offered by huge collections of patient data. These companies have experience in navigating healthcare regulatory processes, and forward-thinking technology companies can look for ways to join forces with them. Companies that figure out how to use this data to address medical needs could transform healthcare worldwide. Wearables work. A new generation of “wearable” technology able to continually monitor heart rate, temperature, exercise, calorie intake, sleep patterns and more could provide unprecedented real-time data that will allow not only wellness monitoring but also deeper knowledge of the effects of different drug interventions. Cardiovascular health monitoring may continue to attract high levels of interest, but by 2035, devotees of wearable wellness monitoring technology may dominate the marketing opportunities, with apps to promote good mental health gaining a strong following. First-movers have the advantage. Corporate players standing on the sidelines of the digital healthcare revolution need to start moving now to avoid being left behind. Those who fail to take the plunge soon will run the risk of losing their competitive advantage. The first businesses that figure out how to collect and use health-related information efficiently, in ways that patients and regulators permit— including through successful crossindustry cooperation—will have lots of opportunities. Patents are not the only way. It is better to get a framework in place to protect your intellectual property as soon as possible, but this should not delay the process of getting a digital healthcare product to market. Whether a company files for a patent may be a business decision rather than a necessity. It may be better to simply treat intellectual property as a trade secret. Education is key. Many patients and doctors don’t fully understand the potential benefits of digital healthcare. Educating our wider population about these benefits and achieving public recognition and acceptance will be a major part of the battle, particularly among older consumers, who may become the biggest users. The cutting edge: Shaping the future of digital healthcare 25

28) Global EMEA Dimitrios Drivas Partner, New York T +1 212 819 8286 E ddrivas@whitecase.com Detlev Gabel Partner, Frankfurt T +49 69 29994 0 E dgabel@whitecase.com Heather McDevitt Partner, New York T +1 212 819 8937 E hmcdevitt@whitecase.com James Killick Partner, Brussels T +32 2 239 25 52 E jkillick@whitecase.com Americas William Choe Partner, Silicon Valley T +1 650 213 0302 E wchoe@whitecase.com Leslie Morioka Partner, New York T +1 212 819 8200 E lmorioka@whitecase.com Jeffrey Oelke Partner, New York T +1 212 819 8936 E joelke@whitecase.com Daren Orzechowski Partner, New York T +1 212 819 8704 E do@whitecase.com Bijal Vakil Partner, Silicon Valley T +1 650 213 0303 E bijalv@whitecase.com 26 White & Case Jost Kotthoff Partner, Frankfurt T +49 69 29994 1275 E jkotthoff@whitecase.com Bertrand Liard Partner, Paris T +33 1 55 04 15 03 E bliard@whitecase.com In this publication, White & Case means the international legal practice comprising White & Case LLP a New York , State registered limited liability partnership, White & Case LLP , a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities. This publication is prepared for the general information of our clients and other interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.